During the coronavirus pandemic, investors focused on companies that were involved in the development of the COVID-19 vaccine. In 2020-2022, Pfizer stock gained popularity among traders. This company in addition to the coronavirus vaccine produces medicines to treat various diseases. Stable income and constant development make Pfizer stock a promising asset for investment.

Pfizer is one of the largest biopharmaceutical companies in the world. Its history began in 1849 in New York. The founders of Pfizer are Charles Fizer and Charles Ehrhardt. At the beginning of its activity, the pharma company was producing the antiparasitic drug "santonin", which quickly began to gain popularity. The company grew steadily and expanded its laboratory and factory.

By 1950. Pfizer had a presence in Canada, Mexico, the United Kingdom, Brazil, Turkey, and other countries. In 2017, the company became part of the Milner Therapeutics Consortium, a global therapeutic society. Its members can share with each other the expertise and scientific data needed to produce drugs.

Pfizer stock is available to investors on international stock exchanges. Investors were particularly interested in the securities of the pharmaceutical giant during the coronavirus pandemic. During the development of a vaccine against COVID-19 the progress of drug trials and sales of the finished product influenced the Pfizer stock price.

The company develops drugs, vaccines, and vitamins. Pfizer produces drugs that are used to treat dermatological, oncological, infectious, and other diseases. The pharmacological giant is constantly expanding, and acquiring new companies. This allows Pfizer to add new drugs to its list of products.

In 2020. Pfizer, along with Fosun Pharma, was acquired by BioNTech to develop the COVID-19 vaccine. This drug has become one of the most well-known and sought-after coronavirus vaccines in the world. In November 2021, the pharmaceutical company began developing a new formula. This was necessary to create a vaccine to fight the rapidly spreading Omicron strain.

After the start of the special operation in Ukraine, Pfizer announced the cessation of investment in the Russian market. However, the company plans to continue supplying medicines to Russia. Representatives of the pharmaceutical corporation explained this decision by its principles of prioritizing patients' health. Pfizer's management added that the money earned from the sale of drugs on the Russian market will be used to provide humanitarian aid to Ukrainians.

The drug maker forecasts that in 2022, the vaccine from COVID-19 will bring the company a profit of about $ 32 billion. Also in the forecast is presented an estimated revenue of about $ 22 billion from the sale of the drug Paxlovid. These expectations are based on contracts awarded through mid-April. The company anticipates that actual earnings may differ from the projected earnings. Pfizer's revenue depends on the rate of growth of COVID-19 infections.

Pfizer Inc. has acquired Arena Pharmaceuticals, a U.S. pharmaceutical company. The deal amounted to $6.7 billion. The bought company develops drugs to treat diseases of the immune, cardiovascular and digestive systems. Pfizer also announces plans to buy ReViral (developer of medicines against the respiratory syncytial virus).

In the first quarter of 2022, the pharmaceutical giant exceeded experts' expectations for revenue. This indicator increased by 77% as compared to the same period last year and reached $25.7 billion. Quarterly revenue of $970 million exceeded experts' forecasts. The adjusted net income for 3 months increased by 74%, reaching $9.34 billion. The earnings per share of Pfizer amounted to $1.62.

Pfizer's vaccine brought the pharmaceutical corporation quarterly revenue of $13.2 billion. Last quarter, this figure was $12.5 billion. The oncology segment for the first 3 months of 2022 increased its revenue by 3.7%, earning $2.97 billion. The internal medicine division reported a 6% decrease in revenue, to $2.44 billion.

COVID-19's Paxlovid tablets were approved in late 2021. During the first quarter of 2022, sales of that drug brought the company $1.47 billion. The pharmaceutical giant is projecting annual sales of Paxlovid at $22 billion.

In March 2020, Pfizer stock was trading at $30. The stock began to actively rise in June 2021. When the coronavirus vaccine began to be in demand, PFE's stock climbed above $50 and reached a price level of $58 in December 2021.

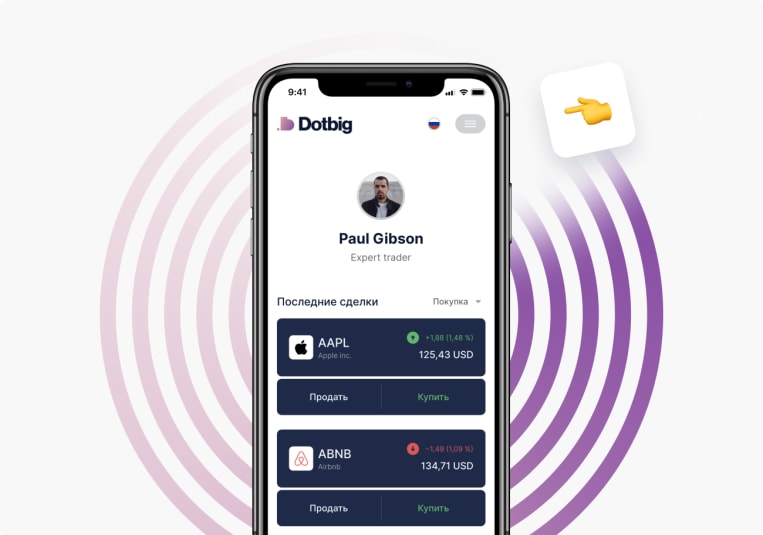

To trade Pfizer stock, log into your personal DotBig account and make an initial deposit.

In May 2021, Pfizer stock was worth $39. In May 2022, the quote rose to $48.

You can trade in automatic mode on the DotBig copy trading platform. You can also connect trading signals or use trading robots.

Zogenix, Vaxart, Biogen, and ALX Oncology Holdings also operate in the healthcare sector.

To authorize on the website and create a personal account, fill out the form, indicating your name, phone number, email address.

After registration, provide an identity document to verify your age and place of residence.

To start trading real money, the initial deposit can be made in any available way.

You can open/close deals on your own under the guidance of an experienced analyst or copy them from other traders.

No trading experience? Not a problem! With social trading, you can copy the trades of the best DotBig traders. Follow the rating and make a profit.

Start trading

Our website and services are not available to, and are not intended for, individuals who are citizens or residents of the United States.

If the above message is shown in error or if you are not a resident or a citizen of the United States of America, you may proceed accordingly. Otherwise, please exit the site.