Allstate Insurance Company can be a good option for investors who want to diversify their investment portfolio. It occupies a leading position in its field of activity and has a good reputation. At the same time, analysts warn that before you start investing, it is worth studying the corporation's financial results and forecasts for the Allstate stock price.

Allstate is among the largest and most recognizable insurance companies in the United States. Founded in 1931, Allstate is one of the first corporations insuring personal risks. It is now considered the largest publicly traded company in its field in North America. With more than 17 million customers and a network of more than 16,000 agents, the insurance giant offers a wide range of products and services, from property insurance to life insurance and pensions.

Allstate Corp. went public in 1993. During its IPO, 78.5 million common securities were listed on the stock exchange. At the time of listing with Allstate, the stock was available to investors at $27. The asset is now traded on the stock exchange under the ticker NYSE: ALL.

In addition to insurance products, Allstate also offers a number of other services such as financial planning and investment services, roadside assistance and even home and auto repair services. The corporation's commitment to customer service and satisfaction is evidenced by a 24-hour customer service team that is ready to help with any insurance issues.

ALL is also actively involved in the community through its Allstate Foundation, which works to improve the lives of those in need through programs such as Purple Purse. This is a program aimed at helping victims of domestic violence. The Allstate Foundation also provides grants to local community organizations and scholarships for students.

The 2022 insurer has to adjust to the current economic and geopolitical conditions in the world. For example, the company raised auto insurance premiums by about 10% from the end of 2021. Homeowners' premiums have also increased by more than 13% since the beginning of 2022. At the same time, the company believes that uncontrolled increases in the cost of services are inadvisable. Such actions could lead to outflow of clients from the insurance company.

Due to difficult stock market conditions and sagging quotes, Allstate has reduced its return on equity investments in 2022. As of October 2022, the company's investment portfolio was about $61 billion. Equity was down nearly 6.5% over three quarters.

In 2022, the company is working to stabilize costs by increasing insurance rates. The corporation's loss for the 2nd quarter of this year alone was $1.1 billion. As a consequence, auto insurance rates since the beginning of 2022 have been raised by a total of about $777 million as of August. Such financial results from the insurer led Wells Fargo, Raymond James and Barclays to lower their stock price forecasts for Allstate.

Allstate shares traded at $130 in December 2022. Technical analysis data showed that the company's securities have the potential to grow to $144 or higher in 2023. The growth in the stock price will continue if the insurance giant cuts its costs before 2025. If the corporation develops at a slower pace, Allstate's share price could drop to $120.

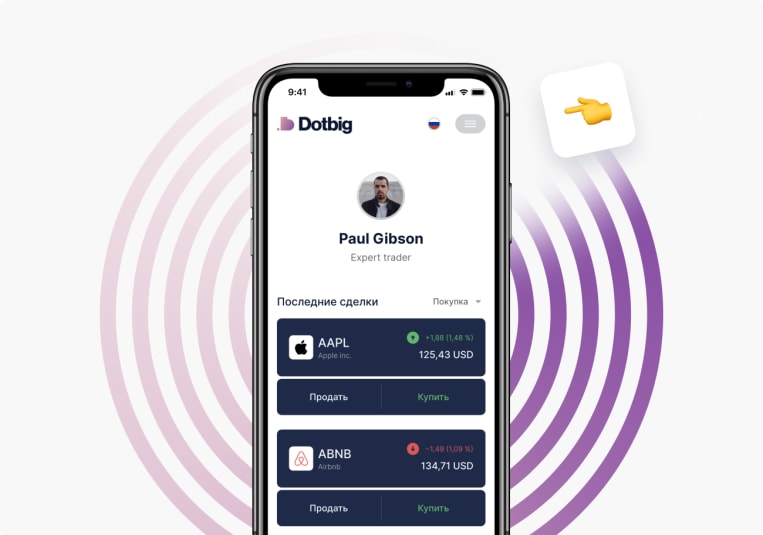

To authorize on the website and create a personal account, fill out the form, indicating your name, phone number, email address.

After registration, provide an identity document to verify your age and place of residence.

To start trading real money, the initial deposit can be made in any available way.

You can open/close deals on your own under the guidance of an experienced analyst or copy them from other traders.

No trading experience? Not a problem! With social trading, you can copy the trades of the best DotBig traders. Follow the rating and make a profit.

Start trading