Bank of America stock prices are now far from their all-time highs. However, many investors are adding this corporation to their investment portfolio. In addition, the holding company pays dividends to shareholders. Securities of this corporation can be considered a reliable asset for long-term investment.

Bank of America Corp. is one of the four largest banks in the United States. The beginning of the history of this financial conglomerate is considered the Bank of Italy, founded by Amadeo Giannini in 1904. In 1928, the company was merged with the Los Angeles bank of the same name. During its existence, the corporation stayed afloat even in times of crisis. Bank of America was formally founded in 1998 after merging with NationsBank.

Now the shares of Bank of America are traded on the NYSE under the ticker BAC. In mid-2021, the company had a capitalization of $344.5 billion. BAC Stock's asset value is significantly lower than that of stock market giants such as Amazon, or Tesla. However, Bank of America stock is attracting the attention of investors who are targeting dividend-paying securities of reliable corporations.

BAC Financial Holding consists of several divisions that offer credit and insurance services to both individuals and businesses. The holding company's divisions include:

Bank of America has recently focused a lot of attention on digitalization. In 2020, the number of mobile banking users exceeded 30 million. BAC has developed Erica, a service based on artificial intelligence. This program can make financial forecasts, make recommendations to improve credit scores, and perform other functions.

In July, the company reported its second-quarter financial results for 2022, and Bank of America's stock price rose 10 percent during the week. However, in the first half of 2022, the financial holding company's stock price has fallen about 25 percent since the beginning of the year. Bank of America's stock was trading at $33 as of Aug. 10.

BAC's higher share price is being hampered by a report of earnings on securities, which came in below the level forecast by Wall Street analysts in the second quarter of 2022. The figure was $0.73 versus the $0.75 forecast.

In July 2022, Bank of America published its financial statements for the 2nd quarter of this year. The holding company's revenues rose to $22.7 billion. As a percentage, this figure increased by about 6%, exceeding analysts' expectations. At the same time, net income decreased to $6.2bn (down 32%).

Bank of America also provided information on consumer loans in the second quarter of 2022. This figure increased by $10 billion. Card loans increased by $5 billion compared to the first quarter of this year. Due to higher tax payments, deposit levels declined by the end of the second quarter of 2022.

When forecasting the direction of Bank of America's stock price, analysts recommend taking several key points into account. Experts are concerned about an increase in provisions for credit losses. Investors should also keep an eye on credit activity. If the economy manages to avoid a recession, Bank of America will generate earnings of about $4 per BAC share.

Bank of America shares are trading at a fairly low price in August 2022. Unless there are global changes in the global economy, Bank of America securities could go up and reach a $50 price level by the end of 2023. Quotes are expected to rise if interest rates remain at decent levels and a recession does not lead to higher credit losses.

To authorize on the website and create a personal account, fill out the form, indicating your name, phone number, email address.

After registration, provide an identity document to verify your age and place of residence.

To start trading real money, the initial deposit can be made in any available way.

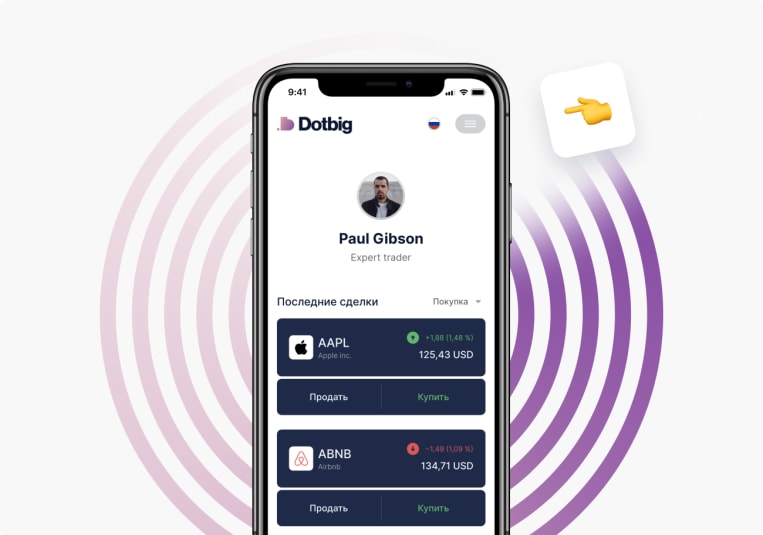

You can open/close deals on your own under the guidance of an experienced analyst or copy them from other traders.

No trading experience? Not a problem! With social trading, you can copy the trades of the best DotBig traders. Follow the rating and make a profit.

Start trading