Coca-Cola is one of the reference brands with more than 100 years of history. Not only does the company stay afloat during crises, but it also raises dividend payments, which makes it especially interesting to investors. You can find out if Coca-Cola stock is worth buying now by reading the company's financial report and analysts' forecasts.

Coca-Cola Company is an American manufacturer of soft drinks. The corporation began its way in 1892 in Atlanta, USA. The founder of the brand was John Stith Pemberton, a pharmacist, who sold in one of the pharmacies of his city a sweet drink on his prescription. Before he died, he sold his recipe to the owner of that pharmacy, Asa Kendler.

Coca-Cola shares were listed on the stock exchange in 1919. Their value at the time of the initial offering was $ 40. Now the beverage company's securities are traded under the ticker NYSE: KO. Since its debut on the stock market, the corporation has split Coca-Cola stock several times. The company's shareholders have been receiving dividends since 1920. The brand has become famous among investors for consistently paying dividends while increasing the payout each year.

The brand specializes in making syrups, concentrates, and soft drinks. The manufacturer also markets bottled water, fruit nectars, and juices. In addition to Coca-Cola products of the same name, the company also produces world-famous Diet Coke, Fanta, Schweppes, Sprite, etc. In total, this brand owns more than 350 regional and world trademarks.

The geography of the company's activities covers more than 200 countries all over the world. The main region for the sale of brand products is the U.S. Drinks of this producer are also sold in Asia, Africa, Australia, and Europe.

Coca-Cola's second-quarter 2022 revenue beat analysts' expectations. Due to its strong financial performance, management raised its outlook for operating results by the end of 2022. However, analysts warned that the main drivers of the financial performance in the second quarter were changes in concentrated beverage sales volumes, adjustments to selling prices, and the impact of exchange rate differences on product costs.

As of Aug. 4, 2022, Coca-Cola shares were up 6%. Over the past year, the beverage maker's securities have increased in value by about 10%. Meanwhile, the Dow Jones Industrial Average and the S&P 500 is down more than 10% over the past six months. The NASDAQ is also showing declining returns. This means that Coca-Cola stock may be a good defensive asset to preserve capital.

Coca-Cola's organic sales increased 16% in the second quarter of 2022. Sales for the three months were up 2% in the U.S. and 6% and 9% in Europe and Latin America, respectively. The beverage company's revenue in the second quarter of this year increased by 12%. An interesting fact is that sales are up despite price increases for Coca-Cola products.

The Coca-Cola shares look even more attractive to investors after the company raised its profit forecast for 2022. So, earlier the corporation expected profit to be in the range of 8-10%, but now the company expanded this range to 14-15%. It also raised its forecast for organic revenue growth from 7-8% to 12-13%. This indicates that the beverage maker will continue to struggle with inflation.

In the short term, Coca-Cola stock could trade at an average price of $70 in 2023. Given the current stock market environment, quotes could range between $65.00 and $76.00 over the next year. Coca-Cola's stock is among the value securities on the stock market. The company, according to analysts, has all but exhausted its growth potential, having made tremendous strides in its business by this time.

To authorize on the website and create a personal account, fill out the form, indicating your name, phone number, email address.

After registration, provide an identity document to verify your age and place of residence.

To start trading real money, the initial deposit can be made in any available way.

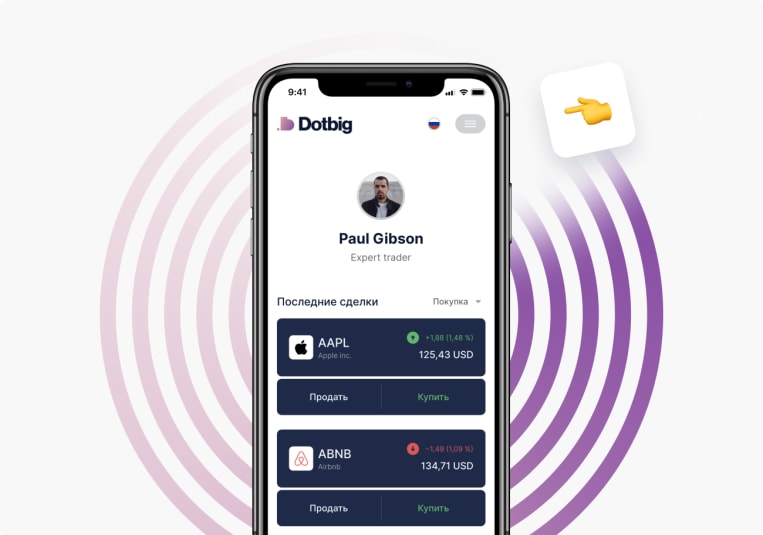

You can open/close deals on your own under the guidance of an experienced analyst or copy them from other traders.

No trading experience? Not a problem! With social trading, you can copy the trades of the best DotBig traders. Follow the rating and make a profit.

Start trading