Amazon stock is a fast-growing asset that attracts retail and institutional investors. This retail giant has stable revenues and has maintained leadership in its sector even in times of crisis. Before you start investing in Amazon stock, study the company's financial performance and keep up with stock market news.

Amazon is the largest marketplace, providing customers with access to different product groups online. The retail giant was founded in 1994 by Jeff Bezos. Initially, the online platform was registered under the name Cadabra and was an online book sales site.

AMZN was listed on the stock exchange in 1997. The marketplace's IPO was priced at $18 apiece. Amazon stock rose quickly in value and was split three times in the two years after its initial public offering on the stock exchange.

In its early days, Amazon was a platform for selling books and comic books. Now this marketplace offers more than 30 categories of products from food to home appliances. The company operates not only in America but also in Europe and Asia. Amazon maintains retail sites in several countries and arranges international delivery of goods.

The corporation owns several lines of business. These include Amazon Publishing and Amazon Studios. The company has also released its line of electronics, which includes tablets, smart speakers, and e-readers.

One of the company's main areas of focus is the Amazon Web Services cloud sector. AWS services products attract the attention of large customers. Amazon's cloud technology will be used by Boeing in aerospace engineering. AWS has also been chosen by technology company T-Systems, which plans to use cloud technology in developing its encryption and data control product.

At the end of the fiscal year 2021, quarantine restrictions and lockdowns helped boost the marketplace's revenue. Online sales brought the company more than 50 percent of total revenue. Despite such results, the corporation lowered its net sales growth forecast for the coming year, indicating the end of the pandemic upswing.

Amazon reported a decline in operating income in the first quarter of 2022. The decline came amid strong inflation and supply chain problems. Analysts are confident that these problems are temporary. However, while the company is trying to cut costs, Amazon stock is falling, losing more than 30% of its value during the first half of 2022.

Amazon stock went through a 20:1 split in June 2022. This reduced the value of the Internet giant's securities. At the end of 2021, Amazon's stock price reached $3,600. After the split, the company's stock price did not go into active growth. However, the Amazon stock split made the corporation's securities more accessible to private investors.

By 2021, Amazon's net income reached $33.36 billion, up 56% from the previous fiscal year. Net sales reached $469.8 billion, up 22%. For 2021, the company posted an operating profit of $24.9 billion.

In the first quarter of 2022, the company reported a decrease in operating cash flow. Operating cash flow was down 41% in the 12 months ending March 31, 2022. Quarterly net sales were up 7% to $116.4 billion. Operating income for the online platform fell to $3.7 billion, down from $8.9 billion in the first quarter of 2021. Net loss reached $3.8 billion ($7.56 per Amazon share).

By 2021, Amazon's net income reached $33.36 billion, up 56% from the previous fiscal year. Net sales reached $469.8 billion, up 22%. For 2021, the company posted an operating profit of $24.9 billion.

In the first quarter of 2022, the company reported a decrease in operating cash flow. Operating cash flow was down 41% in the 12 months ending March 31, 2022. Quarterly net sales were up 7% to $116.4 billion. Operating income for the online platform fell to $3.7 billion, down from $8.9 billion in the first quarter of 2021. Net loss reached $3.8 billion ($7.56 per Amazon share).

After the coronavirus pandemic began, Amazon's stock price began to rise as demand for online sales increased.

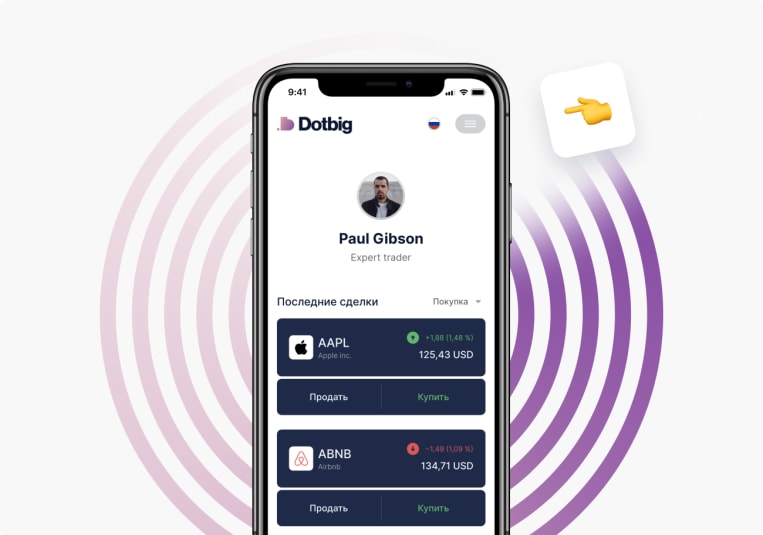

To start investing in Amazon stock, log into your personal DotBig account.

In June 2022, the company split securities after they were quoted above $3,500. Amazon's stock price was then reduced to $110.

/markets/stocks/EBAY/DotBig provides a copy-trading platform, trading signals service, and advisor programs for automated trading in the stock market.

To authorize on the website and create a personal account, fill out the form, indicating your name, phone number, email address.

After registration, provide an identity document to verify your age and place of residence.

To start trading real money, the initial deposit can be made in any available way.

You can open/close deals on your own under the guidance of an experienced analyst or copy them from other traders.

No trading experience? Not a problem! With social trading, you can copy the trades of the best DotBig traders. Follow the rating and make a profit.

Start trading

Our website and services are not available to, and are not intended for, individuals who are citizens or residents of the United States.

If the above message is shown in error or if you are not a resident or a citizen of the United States of America, you may proceed accordingly. Otherwise, please exit the site.