CVS Health shares can be classified as a promising asset for the waiting period of the recession. The company stays afloat even in times of crisis. This is evidenced by strong financial results and the corporation's development plans. A more detailed picture of the dynamics of quotes can be seen in the forecasts of analysts.

CVS Health (formerly CVS Corporation and CVS Caremark Corporation) is an American retail pharmacy and medical company headquartered in Wansocket, Rhode Island. It was founded in 1963 as a medical services company. It later became a pharmacy chain and then a retail pharmacy. The company was founded by two brothers, Stanley and Sidney Goldstein, and their partner, Ralph Hoagland. The first store opened in Lowell, Massachusetts.

The company expanded rapidly in the 1970s and 1980s, opening new stores and acquiring other companies. In 1986, CVS became a publicly traded corporation on the New York Stock Exchange. In 1996, the retailer acquired the Eckerd drugstore chain, which added more than 2,000 stores to the CVS chain. In 1998, CVS acquired Caremark Rx, a benefit pharmacy management (PBM) company, which helped the company expand its reach in the prescription drug market.

The company's pharmacy division, with more than 9,800 retail pharmacies, is the largest in the United States. CVS Health also operates several thousand MinuteClinic medical clinics, Aetna's retail business and provides pharmacy benefit management services for Aetna and other insurers. Its retail pharmacies sell prescription drugs and a wide variety of other products, including over-the-counter medications, cosmetics, beauty products, seasonal items, greeting cards and groceries.

In 2007, CVS acquired the MinuteClinic chain of medical clinics, which expanded the company's presence in the healthcare market. In 2009, CVS Caremark was created as a separate company to focus on the PBM business, and in 2015, CVS Health spun off its pharmacy benefit management business into a new company called Aetna. CVS Health is constantly working to expand its presence in the healthcare market. In 2016, the company announced the acquisition of retail clinic operator Target Corporation. The acquisition was completed in December 2016.

CVS Health has been garnering public attention lately with its plans to turn all of its stores into health centers by 2022. This change is a response to the changing health care landscape, as more and more people seek convenient and affordable ways to manage their health.

CVS Health plans to offer a wide range of services at their health centers, including primary care, mental health counseling and chronic disease management. They also plan to offer on-site pharmacy services and extended hours of operation to make it easier for people to get the health care they need. CVS Health's goal is to provide affordable and accessible health care for all, and the company's plans for 2022 are just the first step in that direction.

CVS ended the second quarter of 2022 with $22.7 billion in revenue in the medical benefits segment. This figure for the corporation was up nearly 11% year over year. It is worth noting that revenue growth in the pharmacy benefits sector brought in $42.8 billion, an increase of 11.7%.

In the first half of 2022, the corporation generated revenue of $157.5 billion. This was more than 11% higher than the previous year. CVS Health's earnings per share were $3.97 in the first half of 2022. For the first six months of 2021, the figure was $3.78. The company managed to increase its pharmacy chain revenue by 10.2% in the first six months of the year. That figure in the retail sector showed a 7.7% increase. For health care benefits, revenue in the first half of 2022 was up 11.8%.

According to technical analysis, CVS stock has the potential to rise to $100 in 2023. By 2025, analysts forecast the company to quote at $130. By 2030, CVS stock could face a slowdown in price growth, which could linger at $134 for a while. The company's quotes could rise as it develops and opens new outlets.

To authorize on the website and create a personal account, fill out the form, indicating your name, phone number, email address.

After registration, provide an identity document to verify your age and place of residence.

To start trading real money, the initial deposit can be made in any available way.

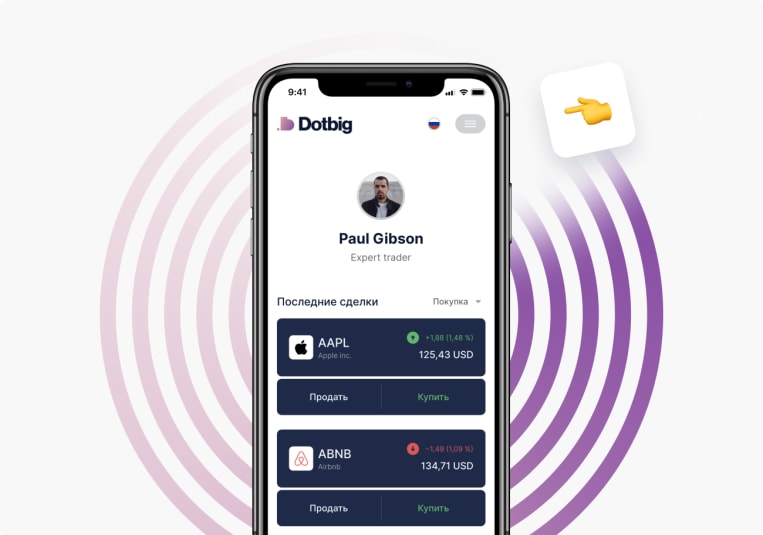

You can open/close deals on your own under the guidance of an experienced analyst or copy them from other traders.

No trading experience? Not a problem! With social trading, you can copy the trades of the best DotBig traders. Follow the rating and make a profit.

Start trading