Nvidia Corporation stock is on the stock market's safe-haven list, despite a slump since early 2022. The company's financial performance depends on market conditions, chip demand, potential supply chain disruptions, and other factors. Before including Nvidia stock in your investment portfolio, study analysts' forecasts and read the company's financial report.

Nvidia Corporation is the worldwide leader in graphics processors. The company was founded in 1993 by Curtis Prem, Chris Malachowski, and Jensen Huang. The initial budget of the startup was $40 thousand. Now the corporation cooperates with the world giants in different areas of the economy: Meta, Tesla, Jaguar Land Rover, and others.

The shares of Nvidia began trading on the stock exchange in January 1999. NASDAQ: NVDA during the IPO was sold at $ 12 per share. You can now buy Nvidia stock on the stock exchange or through brokers. As of March 2022, the company's capitalization had already reached $591 billion.

NVDA develops chips that are used in different areas. The company supplies graphics processors for the development of gaming equipment, onboard computers, and high-performance computing machines. Nvidia technology is also used in professional visualization, as well as when working on programs based on artificial intelligence.

The GeForce brand uses software from NVDA to maintain hardware performance, and also gets the graphics processors from the developer. Nvidia technologies are used in the creation of Tesla gas pedals, GPU Cloud platforms, and Quadro graphics processors. The software of the technological giant is also used in training neural networks.

Analysts say Nvidia is spending big on stock buybacks. In the second quarter of fiscal 2023, payments to investors under this program totaled $3.44 billion. By December 2023, the company is expected to spend another $12 billion on such buybacks. At the same time, insiders over the past year have sold Nvidia stock in an amount that was 5 times the purchase of this asset.

Nvidia's stock price fell 4.6% on August 24 following the release of its fiscal 2023 second-quarter report. Despite the fact that investors were prepared for a decline in the company's performance, the quotes fell. The corporation's management stressed that the decline in revenue was largely due to a decline in sales in the gaming sector.

NVDA's second fiscal quarter of 2023 ended July 31, 2022. At the end of that period, the tech giant's revenue increased 3%, to $6.7 billion, compared with $6.51 billion for the same period the previous year. In the data center sector, that figure rose 61% to $3.81 billion. In the gaming sector, the company's revenue fell to $2.04 billion. As a percentage, that figure fell 33% compared to the same period last fiscal year.

The chip maker's net income fell 3.6 times to $656 million in the second quarter of fiscal 2023. On a per-share basis, Nvidia's net income reached $0.26. By comparison, last year in the second quarter the figure was $0.94 per NVDA security.

Analysts at Nvidia expect that in the third quarter of fiscal 2023, revenue will fluctuate between $5.78-6.02 billion. Some experts predict an average of $6.91 billion, while representatives of the company stressed that lower projections are due not to reduced demand, but to violations in the supply chain.

Over the past four years, the price of Nvidia shares has increased by more than 200%: from $54.77 to $197.71 as of August 26, 2022. If the company continues to grow at the same pace, its fair value will increase by more than 400% by 2030.

Separately, we can make dividend projections for Nvidia stock. Over the past 4 years, this figure has grown by 14%. In 2023 the dividend payments will remain at the current level. With stable development and improved financial results of the chip maker by 2025, dividends will increase at a rate of 87.50%.

To authorize on the website and create a personal account, fill out the form, indicating your name, phone number, email address.

After registration, provide an identity document to verify your age and place of residence.

To start trading real money, the initial deposit can be made in any available way.

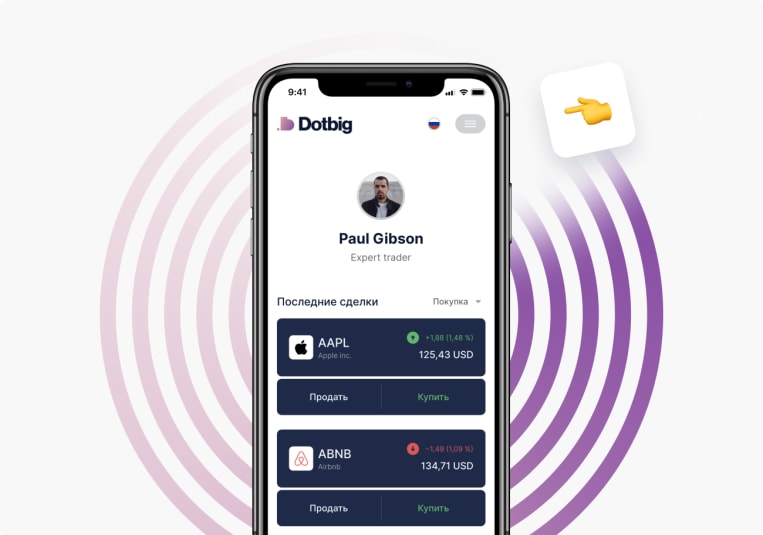

You can open/close deals on your own under the guidance of an experienced analyst or copy them from other traders.

No trading experience? Not a problem! With social trading, you can copy the trades of the best DotBig traders. Follow the rating and make a profit.

Start trading