The technology sector is now considered one of the most promising for investment. Qualcomm shares are an interesting asset for investors who are interested in dividend securities of digital technology companies.

Qualcomm Incorporated is one of the world's largest manufacturers of digital communications products. The company was founded in 1985 and is considered one of the most famous manufacturers of chips for mobile devices, cars, and computers. One of the famous products of Qualcomm is a 5G modem. The device is integrated into premium smartphones.

The company is headquartered in San Diego. Qualcomm shares are listed on the Nasdaq exchange. Major customers of the chipmaker include Nokia, Sony, Xiaomi, Oppo, and other well-known electronics manufacturers. In addition, the company receives income from the sale of patents, as well as investing in startups. The technology licensing business (QTL) accounted for about 20% of Qualcomm's revenue in the first half of this year.

On Nov. 16, 2021, Qualcomm's stock price renewed its all-time high of $181.81. The growth of quotations was observed after the presentation of the new strategy of the company. The shares of QCOM went up when the management of the corporation announced its plans to reduce the production of modem chips and to start actively developing in other directions.

Previously, Qualcomm Corporation positioned itself as a major supplier of chips for Apple. The company also cooperates with Samsung. This makes Qualcomm stock a promising asset for investors because it confirms QCOM's leadership in its industry. However, the cooperation with Apple turned out to be in question. The company was not satisfied with the number of license calculations that QCOM requested. After long negotiations, Apple decided to launch its own production of chips for the iPhone.

Qualcomm's plans for the next few years include increasing its share in the automotive industry. To realize this goal, the organization acquired the Swedish company Veoneer, which operates in the technology sector. On 16.11.2021, Qualcomm and BMW signed an agreement to supply chips for driverless cars.

Analysts fear that chip supplier MediaTek from Taiwan could gain some of Qualcomm's market share. However, the financial performance of the alleged competitor in 2021 did not justify the forecasts. In addition, Qualcomm has started to develop a CPU product by teaming up with Microsoft. This paves the way for the company to enter a new market segment.

Qualcomm's stock price has been on a downward trend lately. The company's last financial report was published on November 3. Adjusted revenue was $9.3 billion, up more than 40 percent from last year for the same period. Net revenue reached $2.9 billion.

The company increased sales in the automotive sector by more than 40%. QCOM stock was trading at $184 on Dec. 28. Despite the decline in quotations, the company continues to hold the leading position in its industry. Sales of smartphone chips also increased by more than 55%, which is associated with the growing popularity of premium mobile devices.

Apple launched the production of its own chips in 2020. But so far the company is not giving up on Qualcomm products and plans to use devices from this manufacturer until 2023. There is no data on the amount of profit Qualcomm made from Apple in public sources. However, Bloomberg reports that this figure reached 11% in 2020. The chip maker's chief financial officer said the company will cover about 20 percent of the iPhone maker's modem needs in 2022. Some analysts do not see this news as a big threat to Qualcomm's share price, as the company will make up for its losses by cooperating with other consumers.

In March 2020, QCOM's stock price was at $58. After the WHO announced the beginning of the coronavirus pandemic, the stock price began to rise.

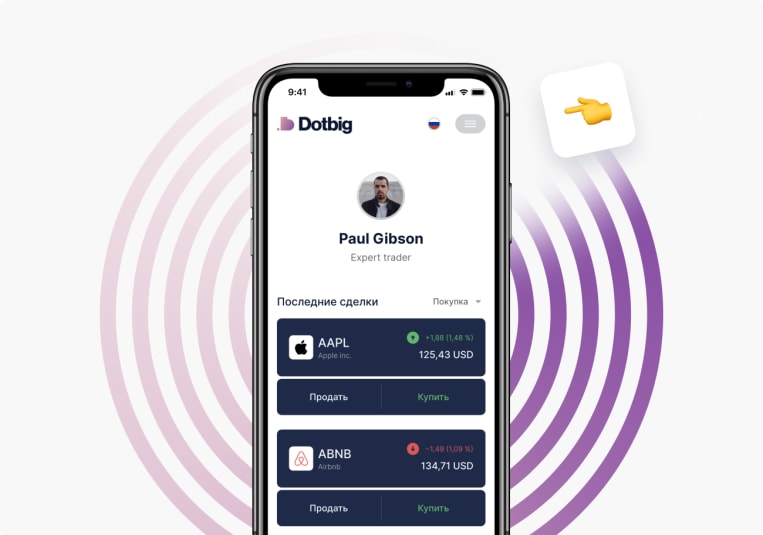

To trade QCOM stock, log into your personal DotBig account and make a deposit.

In May 2021, Qualcomm stock was trading at $137. In May 2022, the stock price rose to $145. During the year October 2021, the quote dropped to $126 before rising to $180 in a month.

To start trading in automatic mode, go to the copy trading platform. DotBig also provides the ability to trade using trading advisors and trading signals.

The Information Technology sector also includes Juniper Networks, NVIDIA Corporation, Broadcom, and Arrow Electronics Inc.

To authorize on the website and create a personal account, fill out the form, indicating your name, phone number, email address.

After registration, provide an identity document to verify your age and place of residence.

To start trading real money, the initial deposit can be made in any available way.

You can open/close deals on your own under the guidance of an experienced analyst or copy them from other traders.

No trading experience? Not a problem! With social trading, you can copy the trades of the best DotBig traders. Follow the rating and make a profit.

Start trading