American Express stock is one of the stock market's most promising assets. The company is notable for its ability to overcome crises, stable profits, and rapid financial recovery after the onset of the coronavirus pandemic. This asset is chosen not only by retail traders but also by big investors like Warren Buffett.

American Express is a diversified American financial company. This organization is based in New York and is one of the 20 largest banks in the United States. Approximately one-third of the corporation's revenue comes from serving overseas customers. The financial giant was founded in 1850. It was formed by the merger of three transportation companies owned by businessmen Henry Wells, William Fargo, and John Butterfield.

American Express shares were listed on the stock exchange in May 1977. The corporation's securities are traded under the NYSE ticker: AXP. This asset has attracted the attention of both private and institutional investors. For example, among the largest holders of AXP stock were Berkshire Hathaway, Inc., Dodge & Cox, and State Street Corporation. Analysts also say that this asset is part of Warren Buffett's investment portfolio.

AXP launched its traveler's checks in 1891. Separate divisions were involved in providing financial services to traveling customers. In 1919, the corporation was refocused on international banking transactions. The first payment card of the organization was issued in 1958. Nowadays, the most famous products of AXP are consumer, corporate, and credit cards, as well as traveler's checks.

The financial group also operates in several other areas besides providing payment facilities to individuals. The corporation provides brokerage services in travel and magazine publishing. American Express provides payment facilities not only to individuals but also to small, medium, and large businesses. The financial giant also operates affiliate networks of credit card transactions.

American Express is seeing an increase in credit card payments. Following the release of its second-quarter 2022 financial results report, the organization reported a 28% year-over-year increase in total dollar billings and transactions. The U.S. economic recovery and increased consumer spending on travel contributed to the increase.

The organization continues to pay dividends to shareholders even in times of crisis. During the pandemic, it did not increase distributions to shareholders, but it did not suspend them, unlike some other corporations. At the end of the second quarter of 2022, the dividend yield on American Express stock was about 1.3%. Analysts also note that the financial giant has increased its payout to shareholders by 160% over the past 10 years. This makes its securities a safe asset in a diversified investment portfolio.

In the second quarter of 2022, American Express announced strong revenue growth. That figure rose 31% year over year to $13.4 billion. Provisions for write-off losses rose to $410 million. Earnings per share for American Express were $2.57, up from a projected $2.41.

The corporation continues to generate solid earnings in the second half of 2022, helped by increased customer interest in American Express products and services. Card upgrades have attracted millions of new users in the 30- to 60-year-old age group. The corporation's spending on customers in this age group increased 48% in the second quarter of 2022. However, the company reported that the investment in capturing this market segment has already been recouped.

In 2023, analysts are predicting an American Express stock price of $176-201. Compared to the price of this asset at the time of the analysis, which was $137, quotes will rise by about 35% in 2023. In 2025, experts expect the AXP stock price to exceed $200, and according to optimistic forecasts, this figure can reach $226. In 2030, the value of American Express stock is expected to fluctuate between $198 and $223.

To authorize on the website and create a personal account, fill out the form, indicating your name, phone number, email address.

After registration, provide an identity document to verify your age and place of residence.

To start trading real money, the initial deposit can be made in any available way.

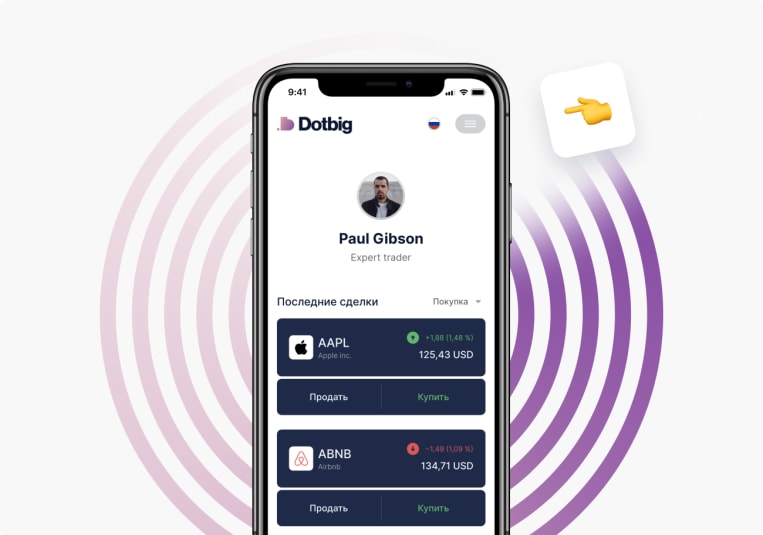

You can open/close deals on your own under the guidance of an experienced analyst or copy them from other traders.

No trading experience? Not a problem! With social trading, you can copy the trades of the best DotBig traders. Follow the rating and make a profit.

Start trading