Salesforce shares belong to the technology sector of the stock market. This IT company competes with Microsoft and Adobe in the cloud computing sector. The corporation attracts the attention of investors by its stability and prominence in its field of activity. CRM stock is currently trading at a fairly low price, making this asset a suitable option for long-term investment.

Salesforce is an American cloud technology company. The company was founded in 1999 by Mark Benioff, who previously held the position of vice president at Oracle. Salesforce is considered a successful company in its field, competing with IT giants such as Oracle, SAP, and Microsoft. In June 2021, the corporation's capitalization exceeded $201.4 billion.

The IT company went public in 2004. Salesforce shares at the IPO traded at $11.00 Now the CRM Stock is available on the NYSE. Investors can buy the company's securities through online brokers.

Salesforce develops software for various industries. The main product of the company is a CRM system of its design. At its core is the Sales Cloud service, which is designed to work with clients and conduct business. For handling customer complaints the Service Cloud solution is used. In marketing, the Marketing Cloud tool is used. It allows sending and tracking e-mails, creating landing pages, conducting campaigns, etc.

IT-company also develops a lot of other products in the sector of cloud technologies. For example, government agencies use Government Cloud, Non-Profit Cloud service was developed for charity organizations, and Healthcare Cloud is used by medical organizations for connecting patients and medical institutions.

In the second half of August 2022, Salesforce's stock price fell 15%. The cloud computing veteran's stock price declined amid a decline in the company's projected financial results for the current year. The unstable economic situation in the world also put pressure on CRM shares. The value of the company's securities may fall amid expectations of rising interest rates and the likelihood of a recession.

Salesforce management reported that the company increased spending on sales and promotion of technology products. That figure rose in the second quarter of 2022 faster than the IT giant's revenue. In addition, Salesforce's adjusted earnings per share fell from $1.50 to $1.19 during that period. Even after that, however, the figure exceeded the consensus forecast of $1.02.

In other news on Salesforce securities, the company plans to conduct a stock buyback. The corporation is going to allocate $10 billion for its first-ever buyback. The IT company's problems include the excessive issuance of Salesforce shares over several years. In part, the new securities were issued to reward employees, but also in connection with the purchase of smaller competitors in the cloud computing industry. The organization now plans to repurchase Salesforce stock to boost free cash flow on the securities.

The second quarter of 2022 ended quite positively for Salesforce. The IT company reported quarterly earnings growth of 22%, which amounted to $7.72 billion. The preliminary forecast for this indicator was $7.69 billion. The corporation reported a slowdown in revenue growth in different divisions of the company. For example, sales revenue increased by 15% in 2022 compared to the 2021 results. The services division saw revenue growth of 20% in both 2022 and 2021.

The company lost approximately $250 million in total revenue during the quarter due to foreign exchange gains. Given the difficult economic and political situation in the world, Salesforce lowered its forecast for annual revenue to the range of $30.9-31 billion. Previously the corporation had expected this figure at $31.7-31.8 billion. According to the new forecast, growth in revenue in annual terms could reach 17-20%, excluding the impact of exchange rates.

According to technical analysis, Salesforce's average share price will be $192 in 2023. In the optimistic scenario, quotes may exceed the $220 mark. In case of an unfavorable economic situation in the world, CRM securities may trade at $157. For 2025, analysts forecast Salesforce stock prices in the $239-268 range. By 2030, quotes could reach the $300 level. The low projections from Wall Street analysts for this year are $193.

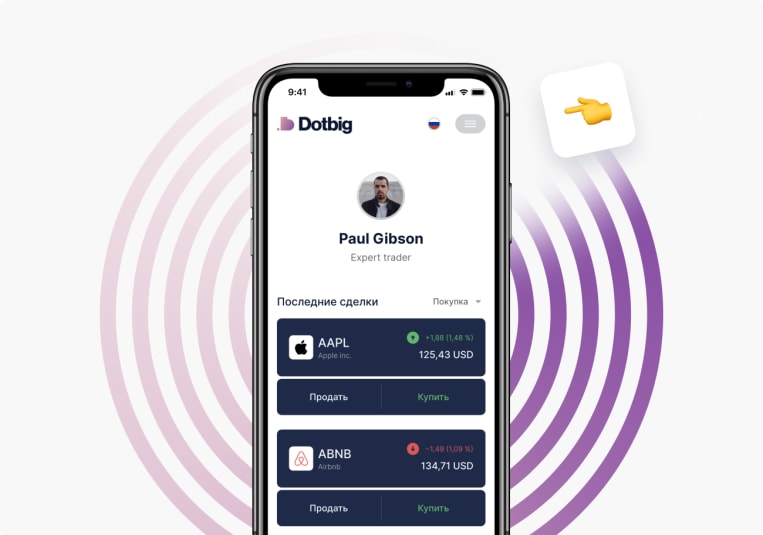

To authorize on the website and create a personal account, fill out the form, indicating your name, phone number, email address.

After registration, provide an identity document to verify your age and place of residence.

To start trading real money, the initial deposit can be made in any available way.

You can open/close deals on your own under the guidance of an experienced analyst or copy them from other traders.

No trading experience? Not a problem! With social trading, you can copy the trades of the best DotBig traders. Follow the rating and make a profit.

Start trading