Devon Energy is attractive to investors because it offers a reasonable rate of return and provides access to diversified oil and gas resources. The main benefits of buying Devon Energy stock are increased returns and passive dividend income.

Devon Energy is a leading energy company based in Oklahoma City, Oklahoma. It is one of the largest independent oil and natural gas producers in the United States, with operations in Oklahoma, Texas, New Mexico, Arkansas and other states. The company was founded in 1971 by John Nichols and has grown into a major player in the energy industry.

Devon Energy stock has been traded on the New York Stock Exchange since May 1991. Over the past few years, DVN asset quotes have been volatile. In March 2020, Devon Energy stock hit a 3-year high of over $27, and in May 2020, it approached $20.

Devon Energy's core business is oil and natural gas exploration and production. The company has operations in the United States, Canada, Mexico, and other countries. Devon is involved in the exploration, production, marketing and transportation of oil and gas. The company also has interests in renewable energy such as wind, solar, and geothermal energy. In addition, Devon owns and operates a natural fuel processing business.

The company is committed to responsible operations and invests in technology to reduce its environmental impact. Devon has implemented best practices for drilling, natural gas gathering, and pipeline operations. It has also developed a rigorous environmental management system to ensure regulatory compliance and reduce the risk of environmental incidents.

As oil prices rise, the company has introduced an innovative dividend structure for Devon Energy stock that pays out up to 50% of free cash flow each quarter after a fixed base amount. As a result, the energy giant's dividend is steadily rising, and investors are getting more reward for investing in this industry leader.

Despite the decline in oil prices, quotes can quickly rise again due to the limited supply of OPEC and SPR reserves. This means that those who invest in shares of Devon Energy and other oil companies can get greater returns on their investments, providing investors with an attractive opportunity to generate additional cash flow.

Devon's third-quarter results far exceeded expectations, with operating cash flow up 32% and production exceeding guidance by 2%. What's even more impressive is that capital expenditures were even 4% lower than budgeted.

The company's third-quarter 2022 report prompted analysts to adjust their target price for Devon stock from $83 to $87 per paper by year-end. The decline in value only encourages investors to buy DVN stock. Traders' interest in the asset is also growing due to the corporation's solid balance sheet and extensive drilling reserves.

On December 16, Devon Energy's stock price was at $61 at the time of the forecast. Based on technical analysis, quotes in 2023 could fluctuate between $60 and $65. On a pessimistic outlook, DVN stock could sag to $54. By 2025, quotes have the potential to rise above $70.

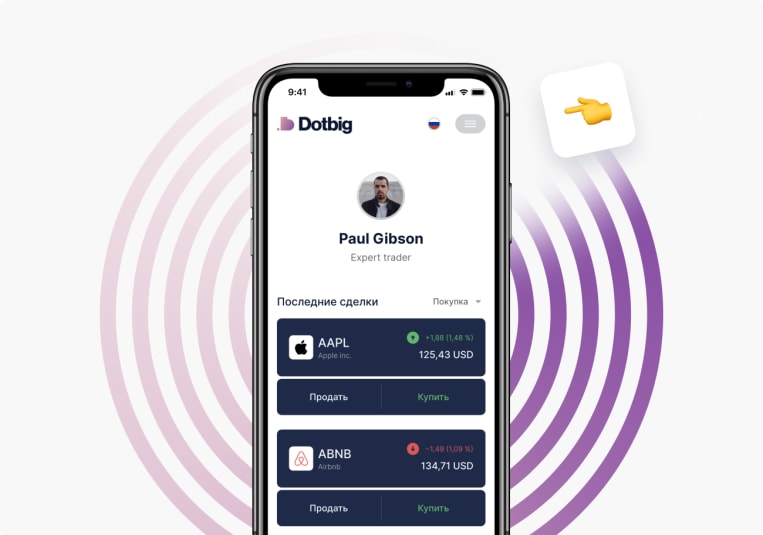

To authorize on the website and create a personal account, fill out the form, indicating your name, phone number, email address.

After registration, provide an identity document to verify your age and place of residence.

To start trading real money, the initial deposit can be made in any available way.

You can open/close deals on your own under the guidance of an experienced analyst or copy them from other traders.

No trading experience? Not a problem! With social trading, you can copy the trades of the best DotBig traders. Follow the rating and make a profit.

Start trading