Home Depot shares are included in the Dow Jones and S&P 500 indices, and have been attracting attention with their stable growth of quotations for the last 5 years. The corporation pays dividends to shareholders even in times of inflation. This asset is considered by analysts and experienced investors as a promising investment that could bring profits in the next few years.

Home Depot is one of the largest home improvement stores in the United States. The company was founded in 1978 by Bernie Marcus and Arthur Blank. Since its founding, the corporation has grown to become the world's largest home improvement retailer. The first store was located in Atlanta, Georgia. The same city is also home to the corporation's headquarters.

Home Depot is a publicly traded company listed on the New York Stock Exchange under the ticker symbol HD. The corporation's IPO was held in 1981. Home Depot shares were trading at $12 per share when the company debuted on the stock exchange. The stock is listed on the Dow Jones Industrial Average and the Standard & Poor's 500 Index.

Home Depot offers a wide variety of products, including lumber, drywall, plumbing, electrical, tools and hardware. Home Depot also offers installation services for many of its products. Home Depot is committed to helping customers complete their projects on time and on budget. The retailer offers a variety of online resources to help customers plan and complete their projects.

Home Depot operates the Home Depot Foundation, which provides funding for community projects focused on housing and disaster relief. The company has more than 2,200 stores throughout the United States, Canada and Mexico. The retailer employs more than 400,000 people worldwide. The retailer is committed to providing customers with quality merchandise at competitive prices.

In the second quarter of 2022, sales at this U.S. retailer were up more than 5 percent. Management notes that most of the corporation's revenue comes from professional contractors who buy construction and renovation products in bulk. As demand for building supplies remains strong right now, Home Depot stock has upside potential.

Despite the home improvement retailer's higher sales levels, there is likely to be a decline in demand for building supplies in the near future. According to statistics, home construction is down more than 14% in August 2022. Mortgage interest rates have exceeded 6%. Because of this situation, investors are thinking about refraining from buying securities of home improvement companies. This circumstance prevents Home Depot stock from recovering quickly from the 2022 drop.

Home Depot is among the companies that pay dividends to stockholders. The corporation has increased its dividend payments nearly six-fold from 2013 to today. During that period, the figure rose from $1.16 to $6.60, as of the end of September 2022. The ability to pay such a fairly high dividend, even in a period of inflation, is supported by the retailer's stable earnings.

Home Depot ended the second quarter of 2022 with reasonably good financial results. The retail chain's sales rose to $43.8 billion, up from $38.9 billion in the first quarter of 2022. Net income increased to $5.2 billion. Home Depot's diluted earnings per share were $5.05, an increase of more than 10%.

Home Depot's profit margin for the second quarter of 2022 was more than 15%. The company focuses primarily on professional contractors and wholesale customers. Thus, the average transaction at the retail chain rose to 9%. Much of this growth is due to an increase in the number of large transactions, which exceed $1,000. The corporation reported a 12% year-over-year increase in sales on digital platforms. This indicates an increase in demand for Home Depot's online purchases.

Due to the difficult geopolitical and economic situation in the world, investors may avoid stocks of companies whose scope is related to consumer spending in the near future. Because of this, the Home Depot stock price is unlikely to recover to its early 2022 level in the short term. According to the technical analysis, the average share price will be around $339 in 2023. This is based on our October 13, 2022 HD stock price of $273. By 2025, analysts expect the retailer's stock price to rise to $800 or more.

To authorize on the website and create a personal account, fill out the form, indicating your name, phone number, email address.

After registration, provide an identity document to verify your age and place of residence.

To start trading real money, the initial deposit can be made in any available way.

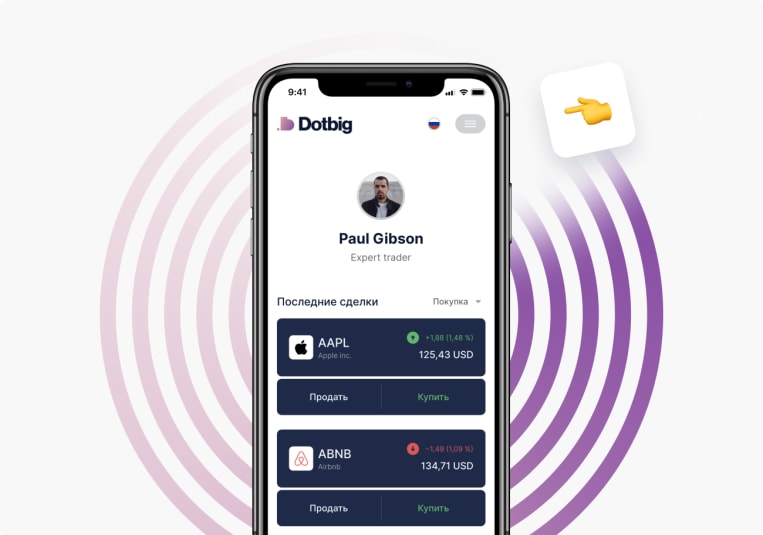

You can open/close deals on your own under the guidance of an experienced analyst or copy them from other traders.

No trading experience? Not a problem! With social trading, you can copy the trades of the best DotBig traders. Follow the rating and make a profit.

Start trading