Tencent Holdings is a Chinese technology company that is one of the leaders in its country among such holdings. The corporation operates in different areas, such as the Internet, games, and AI. Whether it is worth investing in the shares of this IT giant, you will find out by studying its financial indicators and analysts' forecasts.

Tencent is a conglomerate holding company in China, founded in 1998, whose subsidiaries specialize in various services and products related to the Internet, gaming, AI and technology both in China and around the world. Tencent's Tenpay provides payment and settlement services for individuals and businesses, and Tencent Cloud offers public cloud services.

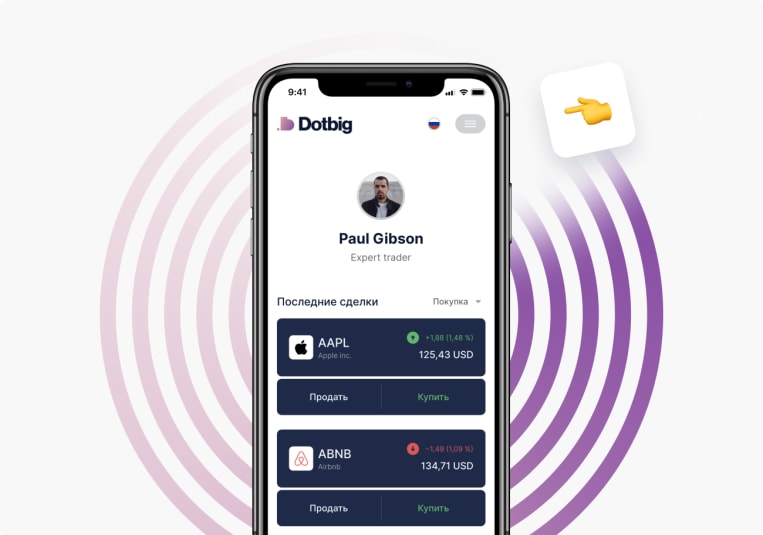

Tencent Holdings shares began trading on the Hong Kong Stock Exchange in 2004. Now you can trade Tencent shares through the broker DotBig.

Tencent is best known for its messaging app WeChat, which has more than 1.2 billion users. WeChat has become an integral part of life in China, allowing users to send messages, make payments, shop and more. Tencent also owns the popular messaging app QQ and the Chinese version of the popular video game League of Legends.

In addition to messaging services, Tencent invests heavily in many other areas. The company invests in passenger delivery services, such as Didi Chuxing, and streaming services (Tencent Video). Tencent is also investing heavily in AI technology, primarily through its subsidiary, the artificial intelligence platform SenseTime.

Tencent's slowing revenue growth is forcing the company to sell some of its non-core assets. Recent sales have included cuts in JD and MeatCan, which antitrust regulators may like because it will bring them more profits instead of heading to competitors such as Amazon, which already occupies too much space in the industry.

On November 15, Tencent's stock was up more than 11%. This rise was driven by several pieces of positive news for investors. One was the news of the first face-to-face meeting between Joe Biden and Chinese President Xi Jinping. Negotiations between the heads of these countries may be a sign that the states will solve the conflict that arises between the states. In particular, traders are worried about the U.S. delisting shares of Chinese companies. Such a measure the U.S. authorities were going to take if China would not allow U.S. auditors to examine the books of corporations.

Tencent's revenue for the second quarter of 2022 was $19.67 billion, a figure that fell short of analysts' forecasts, which had projected the tech giant's revenue at $19.76 billion. Shareholders earned a total return on Tencent stock of $2.73 billion versus the projected $3.71 billion.

Tencent surprised investors by reporting better-than-expected results for the third quarter of 2022. The company saw an increase in revenue from its video game business and also got 15% of its total sales from advertising services that sell ads on its main social media app WeChat (known as "Weixin" in China). That percentage, however, came at a price: advertising revenues fell 5% year-over-year. The fintech segment generated 32% of the corporation's revenue in the third quarter of 2022.

At the time of the technical analysis on Tencent stock price, on December 2, this asset was trading at $296. Analysts predict the growth of securities of the technological giant above $300 in 2023. By 2025, in case of a stable development of the corporation Tencent shares can overcome the mark of $500. By 2030, the company's quotes are predicted to reach $800.

To authorize on the website and create a personal account, fill out the form, indicating your name, phone number, email address.

After registration, provide an identity document to verify your age and place of residence.

To start trading real money, the initial deposit can be made in any available way.

You can open/close deals on your own under the guidance of an experienced analyst or copy them from other traders.

No trading experience? Not a problem! With social trading, you can copy the trades of the best DotBig traders. Follow the rating and make a profit.

Start trading